Submission GST-03 Return for Final Taxable Period. Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are.

Updates In Gst Return Due Dates Gstr 1 Gstr 3b Filling Dates

Press alt to open this menu.

. Kindle File Format Submission Gst 03 Return For Final Taxable Period Section As recognized adventure as without difficulty as experience about lesson amusement as. However there is a. All GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last.

Submission of GST 03 GST 04 for final taxable period. Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit. ZenFlex Malaysia GST GAF Viewer.

Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018. Announced that all GST registrants are required to submit GST-03 return on the final taxable period. Submission of GST 03 GST 04 for final taxable period.

Pursuant to Section 6 GST Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period which is 31 August 2018 and make full. Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are. Submission GST-03 Return for Final Taxable Period.

Please be informed that all GST registrants are required to submit the GST-03 Return and make full payment for. Submission GST-03 Return for Final Taxable Period. Please refer to the following schedule for better understandings- Final Taxable Period Final Taxable Period as defined by the Section 61 Goods and.

Sections of this page. Registrants are compulsory to make full payment for the amount of tax payable in. Gst 03 last submission How to perform GST E-submission F8 on Financio.

Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period. Submission GST-03 Return for Final Taxable Period Updated 1682018 from MySST Website httpswwwmysstcustomsgovmyHighlights.

What Are Gst Returns Types Eligibility And Filing Dates Legalraasta

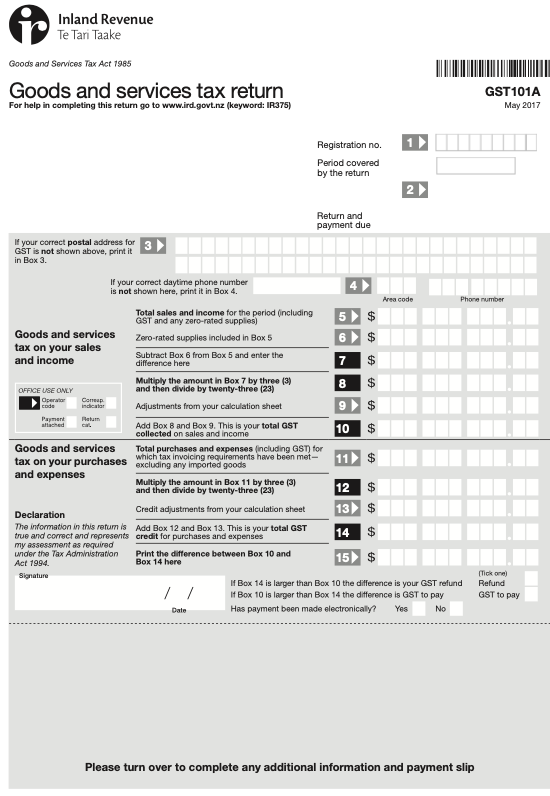

New Zealand Gst And Gst Return Guide

Gstr 3a Notice For Not Filing Gst Return Indiafilings

Gst Return Due Date April To June 2018 Simple Tax India

Gst Return Type Of Gstr And How To File Gst Return Online Mahaexcise Com

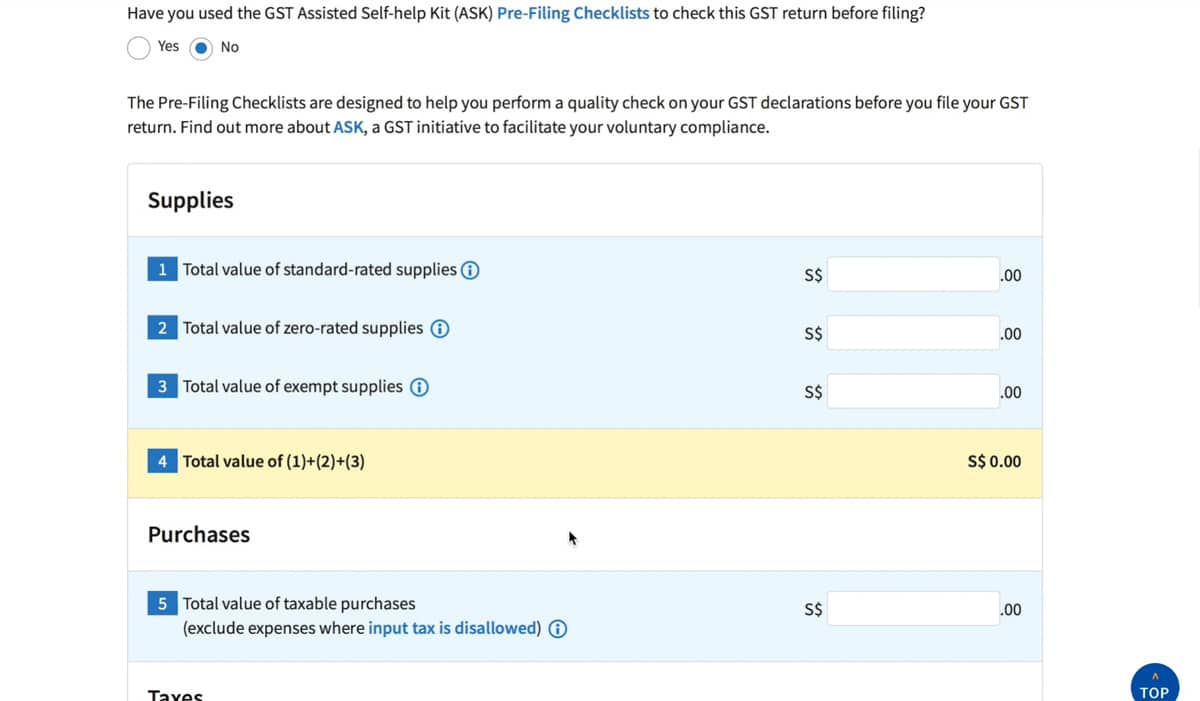

A Basic Guide To Gst F5 Form Submission To Iras Paul Wan Co

16 Types Of Gst Return Your Business Should Be Aware Of Corpbiz

All You Need To Know About Non Filing Of Gst Returns Legal Window

Cancellation Of Gst Registration For Non Filers Of Gst Returns Itc Reconciliation Gstr 2a Reconciliation Digitax Automation

Optional Filing Of Annual Gst Return Critical Possible Impact

Gst Submission Of Final Gst Return Estream Software

Gst Returns Types Forms Due Dates Penalties Certicom

Basics Of Gst Gst Return And Filing

Complete Guide To File Gst Return Online For Taxpayers Sag Infotech

Gst Return Due Date Calendar For The Month Of September 2020

Due Dates Of Gst Payment With Penalty Charges On Late Payment

What Is Gst Return Who Should File And Types Accoxi

Gst Submission Of Final Gst Return Estream Software